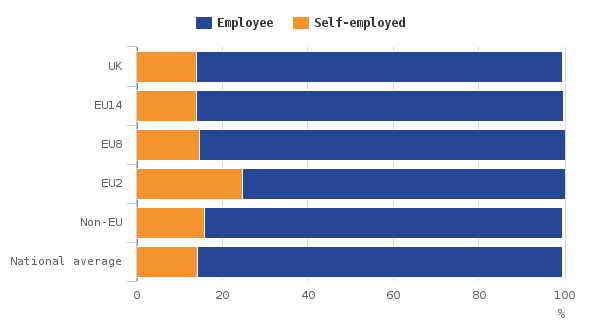

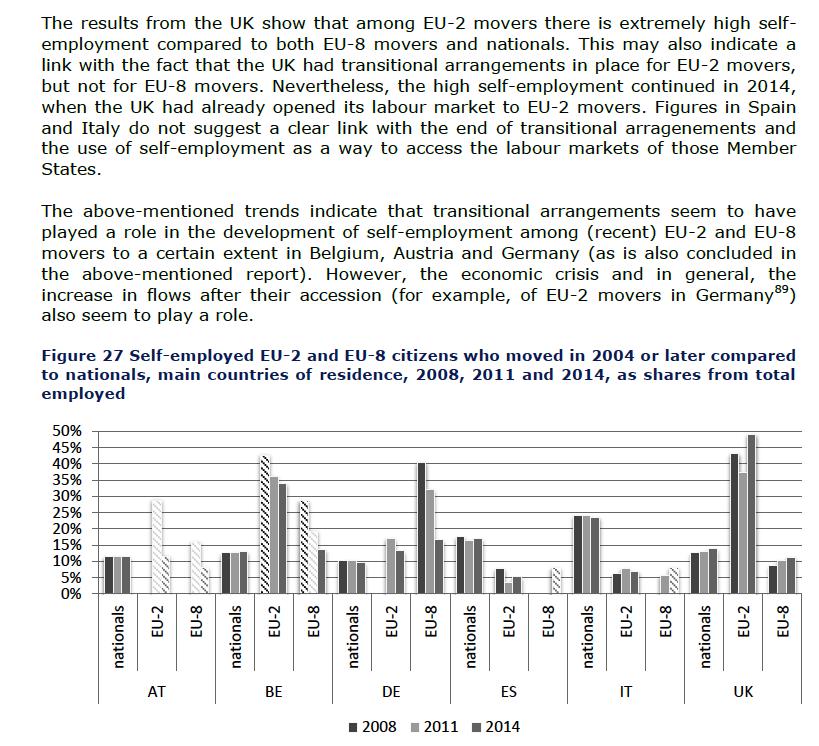

Today’s International immigration and the labour market, UK: 2016 report shows that one in four Romanian & Bulgarian migrants in the UK are self-employed, that is over 56% higher than non-EU migrants who make up the next highest percentage group. No other information on hours worked, pay or contributions is provided on any and all self-employment because of “difficulties in obtaining accurate information”. The problem with self-employment is that it entitles people to all the in-work benefits of a regular job and gives the statistical appearance of working when in actuality many people are just manipulating the system. It was also a means to circumvent transition arrangements and come to the UK before full accession in 2014. They can declare low earnings and will pay no income tax or contribute anything in national insurance but will be entitled to full tax credits, child and housing benefit.