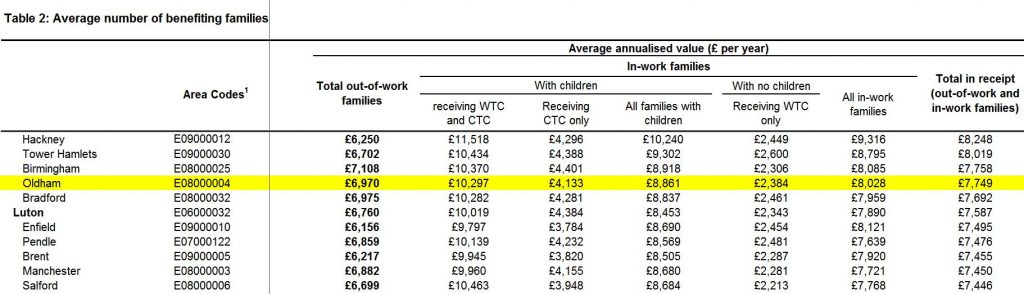

Today’s release of tax credit payment figures for 2016 – 2017 shows that Oldham continues to make the UK’s fourth highest average payment after Hackney, Tower Hamlets & Birmingham. The truly staggering figures for all Greater Manchester shows that over £1.5 billion (£1,506,546,500) was paid out to 211,800 families last year that is the equivalent of every man, woman and child in Oldham being given more than £6,460. That’s £1.5 billion taken directly out of the tax system that should be supporting the economy and UK infrastructure, is it any wonder the NHS is failing when so many in real terms contribute nothing? People won’t like these facts being published because they would rather follow the narrative that it is only businesses who do not contribute a fair share of taxes. It is because of the ludicrous rates of tax credit and benefit payments in the UK that low paid workers here contribute 75% less in taxes than low paid workers in Europe’s most successful economy Germany. Access to tax credits & housing benefit in the UK is one of, if not the, primary driver of unskilled mass migration to the poorest areas of the UK such as Oldham that have no workforce shortages. Note that single people without children working full-time for the minimum wage are not entitled to any tax credits whereas the average payment to working families in Oldham was £10,279.